We sat down for a virtual fireside chat with Jenny Yi, Sr. Community Insights Manager at J.Crew Group, Inc. to learn their secret to long-standing success in the retail space. In such a highly competitive industry, retailers can’t afford to miss the mark, but J.Crew has uncovered the key to navigate the retail landscape—by putting customers first.

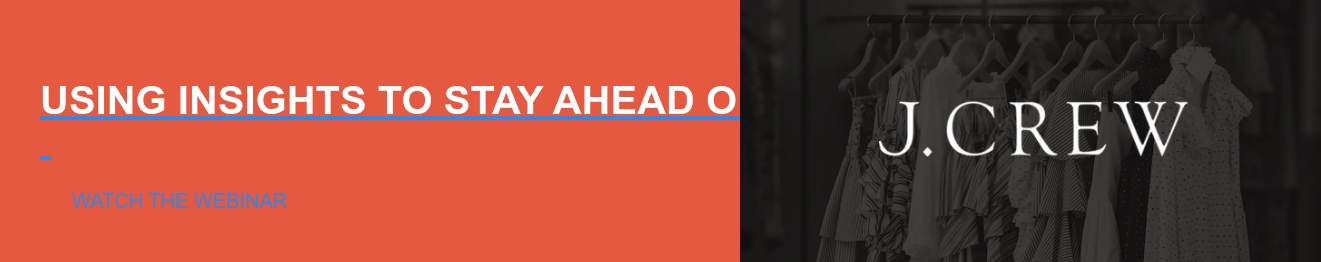

They’ve built a Voice of Customer program, powered by Alida’s TXM platform, that enables the organization to invest confidently into new product lines, prioritize new and existing initiatives effectively, and of course—make sure their customers are at the forefront of these decision processes. Jenny and her team tap into a community of 20,000 J.Crew, J.Crew Factory, and Madewell customers on an ongoing basis to make customer-centric business decisions.

How do you use the Alida platform to identify the difference between a trend worth investing in and a temporary fad?

Finding the balance between a product investment worth our efforts versus a short-lived fad blazing through the market is crucial to J.Crew Group, Inc.’s success. With the rise of social media, fashion trends are gaining momentum faster than ever before, but also fizzling out quicker as well. The tricky part is knowing which trends will be around and whether to jump in on them and how.

The longitudinal nature of the Alida platform allows us to track trends and changes over time, and the rich profile variable capability gives us so much more insights and value to each question asked within our communities.

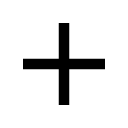

In 2018 and 2019 there was a lot of buzz about athleisure trending in the market. Sweatshirts and sweatpants sets AKA “sweatsuits” were slowly getting popular again (remember this was pre-COVID) but was it just a fad or a new era of comfort? Financial forecasts projected these categories to keep growing, but no one knew for certain what would happen back in 2019, so we wanted to dive deeper with our own customers to validate the trends we were seeing in the larger market via syndicated data sources.

We asked our customers how athleisure fit into their lives and what role it played—how often were they wearing it? What exactly were they wearing and for which activity? Were they working out in sweatpants and hoodies, walking the dog, or going to social events like brunch?

Validating secondary market trend data with our primary customer data was, and still is, crucial to our success because there is so much data out there in the world telling you to go every way, but if the general market is not aligned to your brand and your customers, then maybe it’s not relevant to you and maybe it’s not worth the detour.

Conducting your own primary data, gaining your own customer insights, explained how this big data was relevant to us. And more importantly, understanding the “WHY” behind the number, behind a fad, through our panel was so important for context and direction on how to approach this category.

How do customer insights translate into product and marketing decisions at J.Crew?

All our primary research conducted on the panels—from specific product feedback to more expansive lifestyle and behavioral research—tells us what products to invest in, how to design them to fit into our customers' lives, and how to talk about them in our marketing content to make it relevant for our customers.

We conducted a huge amount of lifestyle research in 2020, because everything we knew about our customer changed that year. From what new hobbies to take on, to what content they were consuming, and what habits they were doing more or less of, all affected their wardrobe choices. We saw the huge shift to work-from-home and how Zoom calls affected their wardrobe choices. We saw new hobbies catch on that made us consider new category expansion lines we never considered before.

In-home usage testing through Alida's platform has been incredibly helpful for us as well. Based on the available sizes we have for testing, we're able to quickly identify a pool of applicants from our communities. We send products to our customers for them to try on, wash, and wear again to really test the fit and durability of items over a long period of time, not just once in a changing room. We look at the whole fit journey, from first fit to first post-wash fit, and afterwards, which is incredibly easy to do when you have a continuous relationship with the customer via a panel. Customers share pictures, ratings, and open-end feedback on the fit of an item across various parts of their body: waist, thighs, calves, etc. so we can pinpoint the exact fit area we can improve on. If and when something doesn't fit, we quickly reach back out to the fit tester because we want to know WHY and how to make the product better so we can provide the best fit experience for all our customers in the future.

Having a set group of customers already in place helps us ensure we are quickly and accurately reaching out to the right audience for feedback, which is key to impactful insights. Otherwise, it can become quite costly if we're not identifying and including the right participants from the start.

There are lots of ways to gather customer data. Why did you choose closed panels powered by Alida?

Building your own customer panel is like having your own vegetable garden. You know exactly what’s in your soil (AKA your sample) and you can cultivate it to match your exact preferences. Having our own panels instead of going to an external panel provider not only saves us an immense recruitment budget and turnaround to kick off a project, but it also gives us more insights into our own customer base than a random sample ever could because we store all of the previously captured data on our products and brand in one place for longitudinal comparisons and subsegment analysis.

You discovered how to give your customers what they need with your approach to Madewell denim—can you tell us about that?

Gathering customer insights is never as simple as broadly asking customers what they want. We work to figure out what customers want and need without directly asking them.

“If I had asked people what they wanted, they would have said faster horses.”

— Henry Ford, Founder of the Ford Motor Company

Rather than asking customers directly how we can change something to drive their purchases, we start from the beginning instead to understand what is driving their purchases in the first place. For example, where are their favorite pairs of jeans from and what keeps them going back to that particular brand? Knowing people's preferences tells us where to focus—it’s about empowering the customer and giving them the options and information they need to make the perfect choice for their unique needs.

Our denim study is a great example. Finding the perfect pair of jeans is hard—finding the perfect pair for women is harder. Fit, body type, size, fabric—our research showed us what product attributes our female customers needed to pick their perfect pair of jeans online. By designing our different denim categories online to match the characteristics customers were looking for, we empowered them to pick their own perfect pair. This allowed us to show we have something for everyone on our website and ultimately decrease return rates online.

What does your customer data tell you about how retail consumer habits are changing over time?

Customer data is telling us that habits change a lot quicker—fads come in hot but also leave just as quickly. But it also gives us insights into how customer values are shifting.

With the help of the Alida platform, one of the biggest trends we are seeing is that sustainability is top of mind. It used to be "nice to have" but now it is a very important aspect of brand consideration and purchase consideration among several key customer groups, particularly with Gen Z. Knowing our company, our associates, and our customers value our sustainability efforts gives us even more confidence to work towards these efforts.

Understanding our customers’ mindset through primary research shows that thrifting and second-hand shopping is becoming a bigger competitor in the retail space. Analyzing those trends and why they have come to be helps us plan for the future. Our customers are becoming increasingly savvy on sustainability and circularity. We have been practicing circularity since 2014 with our denim recycling program, but these deeper customer insights gave us the confidence to take it to the next level. Earlier this year, we partnered with ThredUp to launch Madewell Forever—an online consignment and thrift store dedicated to giving our jeans a second life and promoting more circulatory usage of clothes.

Has your strategy been impacted by the pandemic? If so, how?

We had to relearn a lot. We revamped our competitive landscape, lifestyle, and behavioral research because we realized our customers’ lives, like ours, had been drastically impacted by the pandemic: new jobs, new job locations, new hobbies, etc.

The quickest and easiest way to connect with our customers and relearn this information was through our panels. And it was incredibly valuable that we were able to utilize some longitudinal pre-pandemic data from the panels for comparison.

We were agile and redesigned our research roadmap from March 2020 to August 2020 around what our customers were doing in their everyday lives to see how we could help and reconnect with them through our product offerings and marketing content.

Lastly, what impact has your voice of customer program had on the business?

From the customer standpoint, the panels have allowed us to better identify what customers really need and want from each of our brands through a product lens.

From a business perspective, we have validated and invalidated new expansion ideas. It’s saved untold opportunity costs by figuring out what’s important to our customer and in what direction that leads our merchandising, design, marketing, and e-commerce teams.

By having a quick and continual tap on our target customers, we’re better understanding of our customers and their experiences, which has helped us keep up with the ever-changing apparel landscape.

Despite a difficult year for the retail industry, J.Crew’s approach of making customers a part of the decision-making process has helped them navigate the storm and come out on top. As they look to the future, J.Crew will continue to invest confidently because they’ve built a VoC program that enables them to adapt and grow in-step with their customers.

The next time a hot new retail trend pops up, the J.Crew team will already be well on their way to knowing exactly if, or how much, they should be investing. Making strategic decisions with such confidence is only possible by prioritizing customer empathy and building a world-class voice of your customer program to keep customers at the center of everything you do.

Want to hear more from J. Crew? Check out the on-demand webinar, Using Insights to Stay Ahead of Trends & Competitors to learn how J. Crew validates strategic decisions, saves on opportunity costs, and stays ahead of trends.