For 20 years, NET PROMOTER SCORESM has been an invaluable metric for understanding an organization’s potential for growth by asking one simple question, “How likely are you to recommend company X to a friend or colleague?”

Depending on the response, customers will fall into one of three buckets:

Promoters: loyal customers that will recommend buying from you.

Neutral (or passives): customers who are satisfied but don’t have strong feelings (positive or negative) about your company.

Detractors: Unhappy customers who will not buy from you, and may discourage others from buying from you.

Though simple in concept, being able to answer this question (and have a process in place to make actionable changes from the information) has a big impact on many key business objectives: increasing revenue, customer loyalty, customer lifetime value, better/faster products to market, and so much more.

Twenty years of innovation have expanded NPS programs from a one-question survey into an intricate and sophisticated organization-wide undertaking, but many companies still struggle today to make use of this core nugget of information.

As technology has matured to do more with NPS to connect feedback with action and to get deeper customer insights through integrations—NPS programs find themselves in the midst of a renaissance.

If you’re late to the game with incorporating an NPS program into your organization or trying to figure out why your legacy program isn’t delivering on tangible business outcomes, it’s time to revisit your program.

To get your organization on the right path to success, we’ve highlighted seven core questions you can ask to start identifying areas of improvement. Companies that are able to answer each of these questions with “yes” are well on their way to having an industry-leading NPS program.

1. Is NPS feedback captured from multiple customer touchpoints and channels?

Capturing NPS from multiple touchpoints and channels is necessary for getting an accurate understanding of a customer or consumer’s true feeling about the brand. If your NPS metric is only derived from a single survey (often only run once or twice a year), your data will be skewed. If a customer has a negative support experience two days before they receive an NPS survey, their score will be lower than their true long-term perception of your brand.

Successful NPS programs provide multiple touchpoints that allow customers to provide feedback in real time as part of the overarching NPS program. They reach out to customers as they interact with you to get feedback on individual components within the customer journey to make targeted improvements.

The more touchpoints you’re able to capture in your NPS program, the more accurate your data will be. With more accurate data, you’re able to make better business process improvements.

2. Is NPS feedback actioned into improvement initiatives?

This is where most organizations get it wrong with NPS. It’s commonplace for organizations to say, “we had an NPS program, it didn’t do much for us.” The reality is that these organizations collected information about how customers were feeling but didn’t drill into the details and action improvements from the information.

At its core, NPS is a quantitative metric. It is a tool that can be used to reflect on past performance to identify areas to improve within individual customer experiences and/or with organization-wide process improvements. Without actioning the feedback, you’re missing out on the opportunity that NPS provides.

Modern NPS programs even go beyond just a quantitative metric to include qualitative feedback that encourages customers to go into details and be specific about the causes of their dissatisfaction. This provides even more insight for organizations to make relevant, necessary improvements.

3. Is the NPS collection and review process a formalized program?

When an organization doesn’t have an NPS program with a formal collection and review process, customer feedback often goes into a black hole. Sometimes, even when there is a formal process in place, it’s not well implemented by the organization and feedback falls through the cracks. This can have a very negative impact on your organization.

If months go by without customers seeing the impact of their feedback, you risk damaging the reputation with that customer. If a customer is spending time out of their day to help you improve your product or service, you need to show them the impact their feedback had on the organization. Without this process for closing the feedback loop, you risk turning promoters into neutrals—or even detractors.

A formal process also helps ensure feedback is getting to the right teams responsible for making the improvements. Everyone involved in the program must understand the follow up process and how feedback is routed to the appropriate teams. It must be done in a way that ensures proper teams consume the right information.

Some of the largest companies in the world track NPS survey results in a single, static spreadsheet. This leads to inconsistent performance and exposes the organization to a lot of risk around not following through on the feedback received from customers.

4. Are your company leaders champions of capturing customer feedback and improving customer experience scores?

At the highest level of your organization, you have to care about improving the customer experience. It’s not enough to ask the question if you don’t care about the answer. Customers can tell if you’re pretending to care. That goes for anyone who interacts with your brand. You have to thank them for their feedback and show them the positive improvements to come from it. Whether that feedback relates to product, brand, customer support, or any other department, having buy-in from the senior leader of that team is table stakes for ensuring actionable changes are being made.

At the corporate level, CX metrics should be captured on executive dashboards, measured over time, and reported to senior leaders to inform what direction you’re going and what is being done to continue to push in the right direction. It goes beyond simply moving the needle.

5. Is employee performance or compensation tied to NPS?

Many companies make the mistake of tying CX metrics directly to compensation. “If you don’t move the needle, you don’t get a bonus.” This incentivizes bad behavior and often leads employees to manipulate the system to get the metric they need vs improving the experience for the customer. It’s the wrong way to offer monetary incentives and is highly susceptible to corruption.

The right way to incentivize is to tell the stories of how you turned detractors into promoters, and how you were able to directly impact a customer. These stories humanize the customers and provide great rallying tools for the organization to see and understand the importance of CX improvements.

It’s not wrong to attach employee compensation to some metrics, but it’s important that those metrics are relevant to each team assigned to them. Corporate NPS is incredibly vague for a product engineer. If they can’t see how the work they do is tied to the figure in a real way, they will struggle to deliver. For that same product engineer, focus on metrics like product NPS, number of features delivered, customer adoption of new features, etc.

6. Are there NPS reports or dashboards available across the organization?

Best-in-class customer experience organizations look at NPS dashboards every month, broken down by the functional areas of the organization they’re measuring NPS for (product, brand, corporate, customer service, etc.). It’s important to also share those metrics across the business. Let your employees take pride in the amazing work they’re doing to improve the customer experience. Other teams will rally behind the value-add metrics.

Companies that get this wrong often have multiple versions of dashboards all over the place and different programs that hit customers from multiple directions across multiple teams. We’ve seen examples of customers getting over 20 survey requests from a single organization in one day. This lack of centralized control puts the burden on the customer to figure out what is important to you–and they aren’t likely to expend the effort. With poor response rates and disparate feedback collection throughout the customer journey, you risk degrading their opinion of your brand. You need a single source of truth to identify trends and topics that need further investigation.

7. Is there a single, unified NPS platform used across the company?

As mentioned above, there should be a single source of truth for NPS management within the organization. Everyone should have awareness of the platform and it should be well defined. There can be multiple inputs into this program, but ultimately you’re looking for a hub-and-spoke approach where the data is collected in a way that makes it meaningful to business stakeholders.

Customer satisfaction and loyalty scores like NPS can take many forms within an organization, and they all need to be visible to everyone in real time. The best way to do this is by implementing a single platform that is shared amongst teams. Just be cautious about your integration strategy so you don’t introduce too much complexity and make the solution tough to manage.

Don’t give up on NPS as a metric just because you’ve had a bad experience with it. It’s okay to get it wrong, and it’s okay to seek out help to ensure you’re maximizing the value for your company and customers.

A proper, actionable NPS program is not built overnight–and it requires buy-in from every department in the organization to get right.

By putting a plan in place to account for each of these core considerations, your organization is well on its way to implementing a best-in-class NPS program that will help drive unparalleled growth for the organization and drive additional value through increased revenue, customer satisfaction, and more.

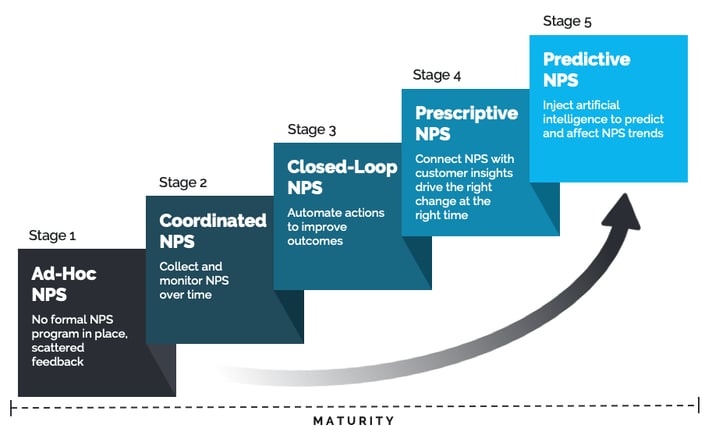

ADVANCING THE MATURITY OF CX

NPS is often criticized for not being prescriptive enough. Companies can struggle to correlate NPS scores with tangible business outcomes. Sometimes the scoring methodology is at fault, sometimes it's the implementation—but most of the time the reason why NPS programs fail is the lack of appropriate follow-up. We believe that NPS is an effective first stage in CXM program maturity. Can you get value from NPS alone? Yes. NPS scores will give you directional guidance on how your brand is perceived by the most important people—your customers. Is it the be-all, end-all solution that you need to generate customer loyalty and steal customers away from your competition? No, but it's a good first step on the maturity curve. What we are seeing is that, as technology has matured to do more with NPS to make it prescriptive through connecting feedback with action, and to get deeper customer insights through integrations with customer engagement solutions–NPS programs find themselves in the midst of a renaissance. In recent years, and even more since the pandemic, customers are approaching us about NPS as a starting point in their customer experience management journey.

There are 5 stages of the maturity model, from informal, scattered feedback (or none at all) to a predictive approach bringing in artificial intelligence to prescribe improvement initiatives. We developed the maturity model to help our customers cut through the noise of too much customer data in too many places and move towards a state where the most important customer experience indicators are captured and used to drive the type of improvements that lead to competitive advantage.

Stage 1 is when you don't have a formal program in place. This doesn't necessarily mean you aren't surveying your customers. In fact, you might be over-surveying them with a constant stream of questions from teams across your business using a variety of tools and data formats. A heavy customer survey burden depresses response rates and can actually negatively impact the perception of your brand. I have personally received distinct surveys from a single vendor multiple times in a single day, many asking me the exact same questions. The most common reaction is to hit "unsubscribe," and that reaction alone is justification to do something differently. But there's more you need to consider. If you have a decentralized situation with no clear understanding about how customers feel about your brand, your products, your services and customer experiences, it's really hard to plan meaningful improvements - or to even recognize that they need to happen before a competitor overtakes you. Cautionary tales about defunct brands often begin this way.

Stage 2 in the maturity model is about 1) understanding the business impact you hope to achieve by implementing an NPS program 2) gaining buy-in from the stakeholders across the business to ensure the NPS feedback collected is going to materially inform and direct customer experience programs and 3) implementing the program in the right way to keep the flow of NPS feedback flowing - so you can take proactive or corrective action in an agile way.

From a practical point of view, this is the implementation of either (or both) a corporate level NPS survey and functional ones (product NPS, etc.). This stage requires integrated people, process and technology to ensure the right audience is engaged, at the right time, and the results not just make their way back into the hands of the stakeholders, but that a process exists so the stakeholders can follow-through on the comments collected from promoters and detractors. Stage 1 maturity requires a certain degree of technology sophistication - the ability to see trends over time, the ability to parse text and detect sentiment from comments shared as part of the NPS survey (beyond the score) as well as the ability to share results with business stakeholders. But it also requires buy-in from the various stakeholder groups so there is no break in the process that could devalue the program. There's nothing more frustrating than taking the time to provide feedback, only to find that nobody does anything with it. This follow-through must be operationalized or the NPS program will fail.

Stage 3 is about closing the loop on NPS scores and additional feedback provided, automating responses and other actions based on meaningful criteria specific to your business to ensure appropriate follow-up from your functional stakeholders such as the products team, customer service organization, marketing team, etc. From a technology perspective, this means taking in the NPS scores and other customer attributes and then running that data through a tailored set of rules that will determine the next step—either automated or manual.

An example is: Detractor survey received from customer -> Processed by the rule engine which determines the customer is both a detractor and a member of a key customer segment critical to revenues -> a case is created and assigned to a customer success manager to make contact to work through the root cause of the issue OR an automated apology and special offer are sent.

The end to end workflow is managed within a single platform so customer experience leaders can see the closed-loop nature of the feedback, and identify root causes that can drive improvement programs.

Stage 4 is where you drill into the details to prescribe solutions in partnership with a connected customer insights platform - understanding not just "why" a certain NPS score was provided, but determining which specific improvements should be prioritized to change the course of the perception of your brand, products and services. At this stage of maturity, you are informed by customers who care about being heard to improve the products and services they consume from your brand - as you decide upon and make your improvements to customer experience. Companies at this level of maturity are testing concepts and approaches with a group of well-profiled customers so they know how to meet the needs of their target customer segments, truly making the end-to-end NPS program into a competitive differentiator. This is an area where great strides have been made in recent years to better understand and engage with customers at scale using a customer insights platform - meaning companies no longer have to be reliant upon infrequent meetings of user groups or customer advisory boards where only a handful of people get to contribute. Our most mature customers are connecting these deep insights with NPS score data and the closed-loop CXM engine to drive the most informed and lowest-risk improvement programs to create a competitive advantage.

Stage 5 maturity is where the most mature organizations operate. These brands combine direct feedback (when customers talk to you) with indirect data (when customers talk about you) with inferred NPS based on look-alike modeling for known audiences. These companies bring in data from social listening tools to see how their brand is perceived by people that haven't responded directly to a survey. They ascertain where events have taken place along the customer journey that are likely to have an adverse impact on customer loyalty. They action the indirect, direct and inferred feedback in the CXM rule engine, make the known and projected NPS scores available to stakeholders, allowing them to drill into the sources of the information - and help brands predict measurable improvements to NPS that can be achieved through the implementation of recommendations offered through artificial intelligence. This level of maturity is proactive rather than reactive, and gives brands a real opportunity to inject voice of the customer into the most strategic decisions the company makes. This is what it means to truly have a pulse on customer sentiment.